XRP Sees 13% Increase as Historical Indicators Suggest Recovery

XRP Sees 13% Increase as Historical Indicators Suggest Recovery

XRP has demonstrated significant recovery, reclaiming about 50% of its previous losses. Currently trading at $2.29, the altcoin is testing the critical resistance level at $2.33.

For XRP to sustain this upward trend, it will require continued backing from investors, support which appears to be strengthening.

XRP Investors Remain Optimistic

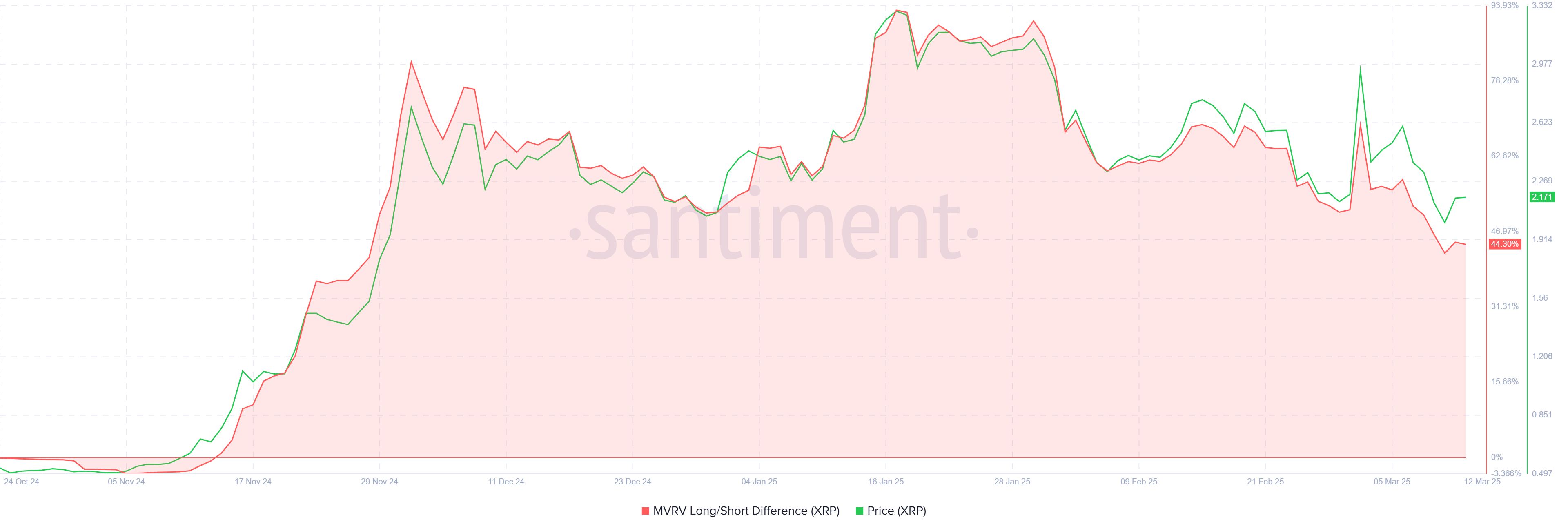

The Long-Term Holder Net Unrealized Profit/Loss (LTH NUPL) metric reveals that long-term holders are currently enjoying profits. This element is vital for XRP's price dynamics since holders typically refrain from selling when they are in profit. Their commitment to holding their investments provides key support to the price stability.

Historically, a crossing of the LTH NUPL indicator into the Euphoria zone often triggers a significant price surge. This trend has led to previous rallies, and many analysts suggest that XRP could observe a similar path if current conditions persist. With long-term holders maintaining their positions, XRP's price may continue its ascent.

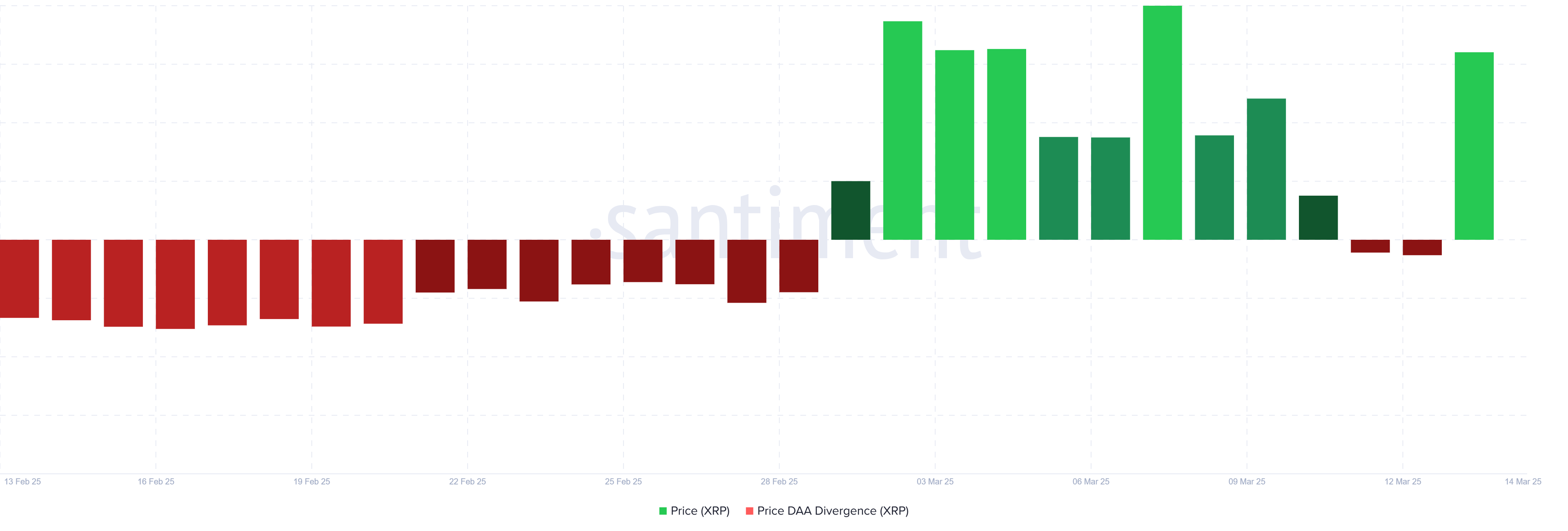

On a broader scale, the Price DAA Divergence indicator currently produces a buy signal. This divergence suggests that an increase in both price and daily active addresses (DAA) indicates rising investor engagement.

The growing number of active addresses signifies heightened trader confidence in XRP’s prospects. Coupled with the current price increase, this trend could foster XRP’s ongoing recovery.

Challenges Ahead for XRP Price

XRP has experienced a significant rise of 13% over the past four days, with its current trading price at $2.29, marking a recovery from a recent 22% decline. The altcoin is closely approaching the pivotal $2.33 resistance, which it must surpass for further bullish momentum. Should XRP manage to break through this level, it could aim for $2.70, effectively regaining its prior losses and potentially rising even higher.

All discussed factors suggest that XRP possesses the necessary momentum to continue its recovery route. Backing from long-term holders and favorable indicators offer a robust basis for further price enhancements.

However, should XRP fail to break the $2.33 barrier and retrace to $2.14 or lower, this bullish outlook may be compromised. A decline to $1.94 would erase recent gains and position XRP back into bearish territory. Therefore, it is critical to maintain support at $2.33 to assure the continuity of its upward trajectory.