POPCAT Faces a 48% Price Decline; Will Robinhood's Listing Spark a Recovery?

POPCAT Faces a 48% Price Decline; Will Robinhood's Listing Spark a Recovery?

Since early February, POPCAT has encountered serious challenges, struggling to recuperate from a staggering 48% price drop. Although there have been occasional rallies, these efforts have not translated into a recovery, maintaining pressure on its market performance.

As POPCAT persists in its recovery attempts, the absence of robust support and optimism in the market continues to delay any substantial bounce-back. Nevertheless, the meme coin experienced a significant bullish moment recently.

POPCAT Requires Strong Investor Support

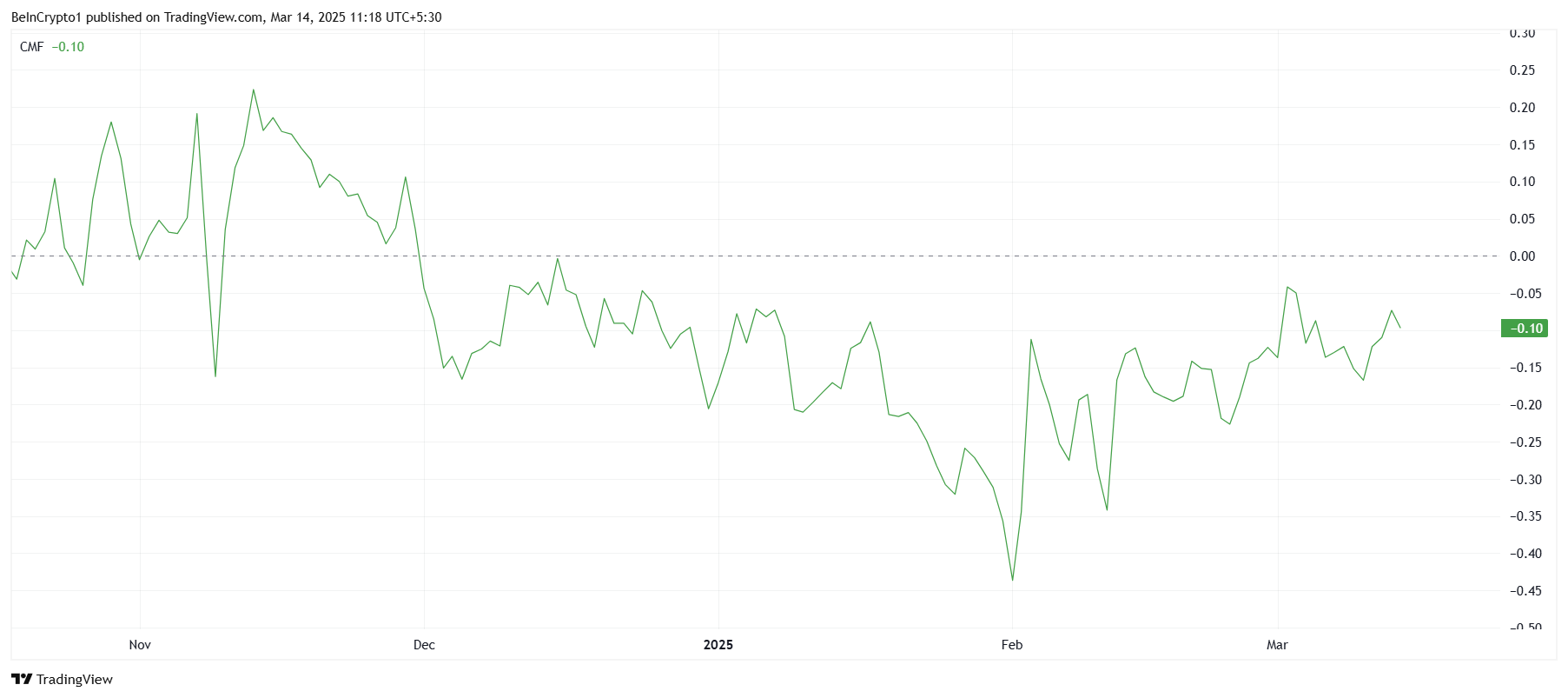

The Chaikin Money Flow (CMF) indicator has remained firmly below the zero line for over three months, indicating persistently low inflows into POPCAT since December 2024, resulting in minimal buying traction. Investors’ reluctance, mainly due to fear of losses, has fueled a lack of momentum, thereby inhibiting a recovery.

The weak CMF suggests that investor interest in POPCAT is lacking, which is preventing any meaningful rise in its price. This stagnant condition continues to challenge the altcoin’s ability to produce positive price action.

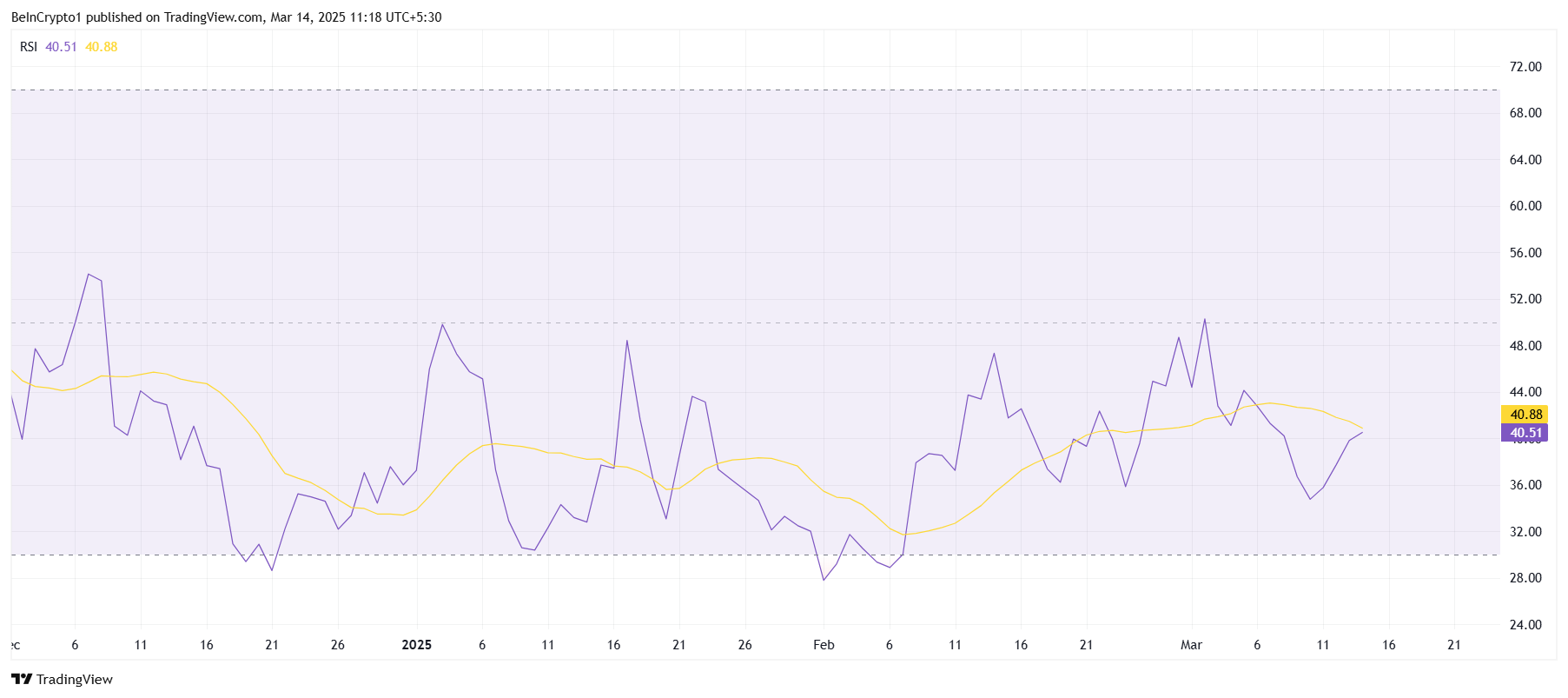

Technical indicators like the Relative Strength Index (RSI) further reveal POPCAT’s difficulties in maintaining momentum. The RSI has remained under the neutral threshold of 50 for three months, indicating weak buying signals. This further corroborates that general market conditions are not conducive for a robust recovery.

Without backing from broader market trends, POPCAT continues to grapple with breaking free from its current downtrend. Until the market environment improves, a breakthrough of its bearish trend remains unlikely.

Current Price Trends of POPCAT

In the past four days, POPCAT has experienced a nearly 20% increase, currently trading around $0.180. A central factor in this rise was Robinhood’s recent listing of POPCAT on Thursday, which has the potential to attract additional investments and expose the coin to a wider investor base.

Having rallied off a support level at $0.140, POPCAT is now facing resistance near $0.203. While this recent uptick is promising, overcoming the $0.203 threshold will be challenging.

Given the prevailing weak market sentiment, POPCAT may find it difficult to surpass the $0.203 resistance. It appears more probable that the altcoin will remain within a consolidation range spanning from $0.140 to $0.203 until stronger market signals materialize, which could further postpone its recovery.

However, should market conditions and investor sentiment improve, there is potential for POPCAT to break through the $0.203 resistance. A successful move past this level could see the altcoin attempt to test $0.238, effectively negating the current bearish outlook and marking a shift in market sentiment that may foster a more sustained recovery.