Cardano's Struggles: Can ADA Rebound as Traders Exit?

Cardano's Struggles: Can ADA Rebound as Traders Exit?

Cardano's ADA has faced significant challenges over the last month, currently trading at $0.70, down nearly 10%.

This price decline reflects broader obstacles in the cryptocurrency market, leading many short-term investors to reduce their holdings rapidly.

Short-Term Traders Are Exiting—Will ADA Stabilize?

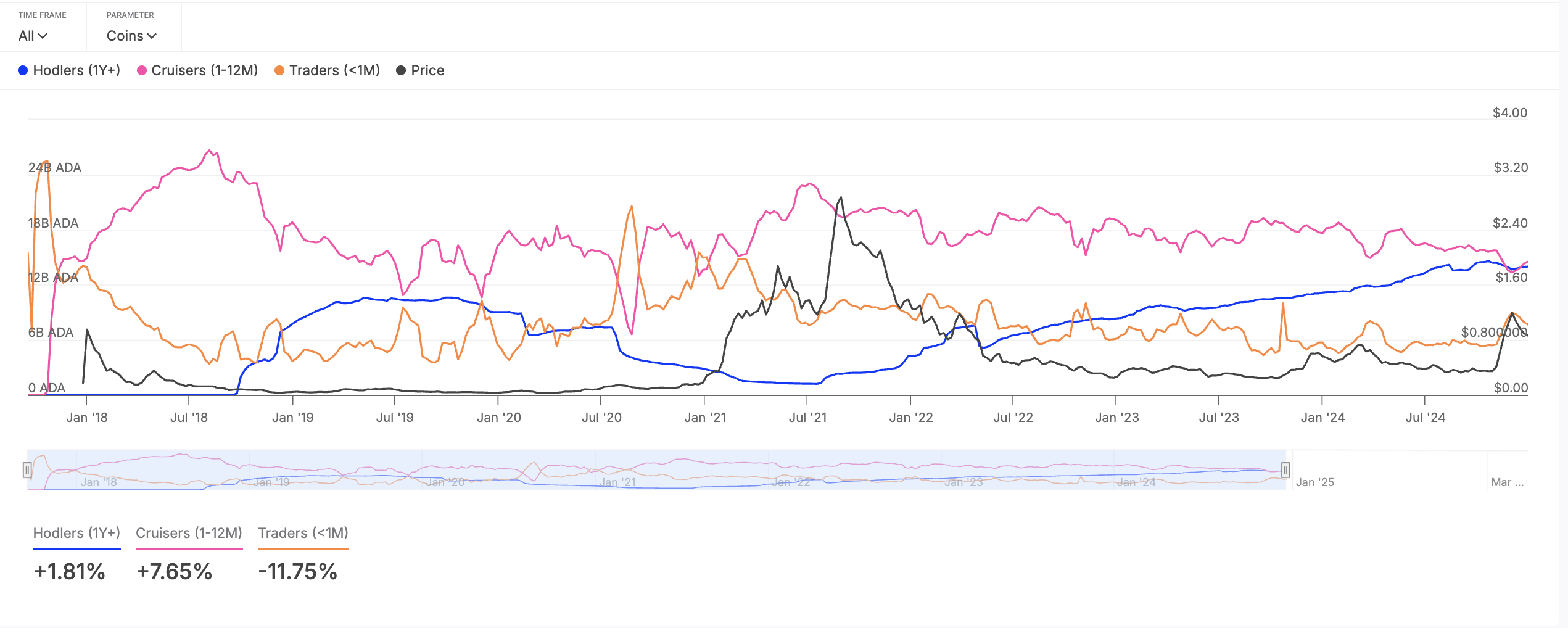

Short-term holders (STHs), who typically maintain assets for less than a month, have drastically decreased their ADA holdings amid a bearish market sentiment.

As reported by IntoTheBlock, the average holding time for these investors has reduced by 12% in the previous month, further amplifying ADA's downward trajectory.

This increased sell-off indicates a declining confidence in ADA's potential for a short-term recovery. Continued selling pressure could mean that ADA may struggle to establish a robust support level unless long-term investors or institutional buyers step in to absorb the sell-offs.

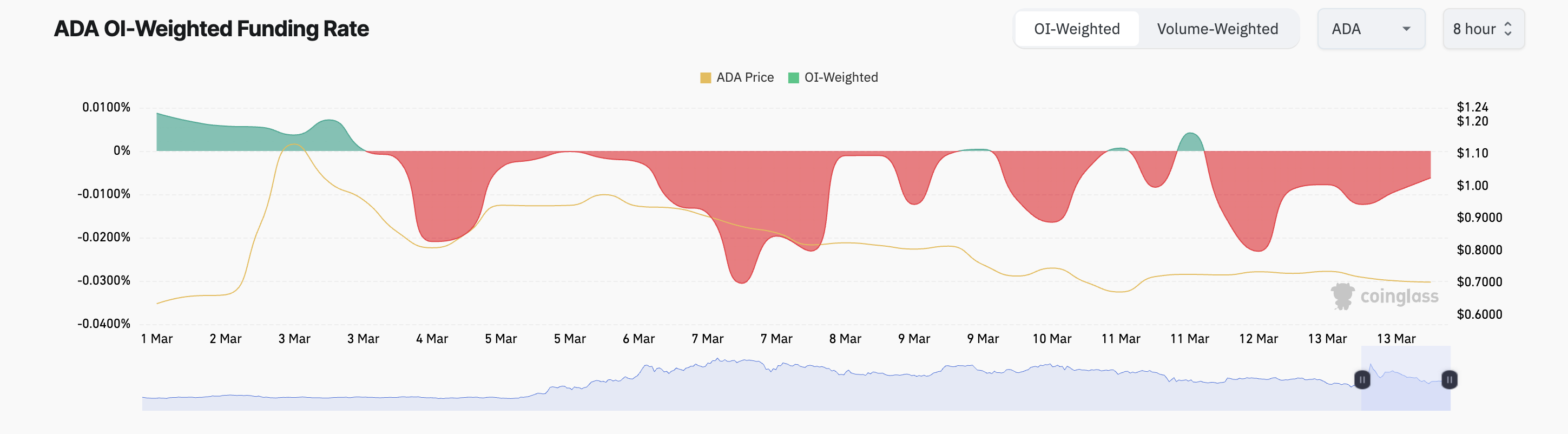

Furthermore, ADA’s funding rate in its derivatives market remains negative, confirming the overall bearish outlook. As per data from Coinglass, ADA's current funding rate is at -0.006%.

The funding rate is a fee exchanged regularly between long and short traders in perpetual futures contracts to align prices with the spot market. A negative funding rate indicates that short traders are paying long traders, reflecting the prevailing bearish sentiment, with more traders anticipating price declines.

ADA Faces Intensified Selling Pressure

The current decline in ADA has pushed its price below the 20-day exponential moving average (EMA) on daily charts. This indicator provides insight into the average price of the asset over the past 20 trading days, emphasizing recent price shifts.

When an asset's price falls beneath this significant moving average, it signals a potential weakening in market momentum, hinting at a shift toward a short-term downtrend. This scenario raises a bearish outlook, indicating further selling pressure and the potential for price drops.

If this trend continues, ADA’s price might drop to around $0.60.

Conversely, if a bullish trend emerges, ADA could break above the $0.72 resistance and push towards $0.82.