ADA's Struggles: What Lies Ahead for Cardano Amid Selling Wave?

ADA's Struggles: What Lies Ahead for Cardano Amid Selling Wave?

Cardano’s native cryptocurrency, ADA, has encountered significant turbulence over the past month. Currently valued at $0.70, it has experienced a downturn of nearly 10% in value during this period.

This decline is largely attributed to prevailing market challenges that are impacting investor confidence, motivating short-term holders (STHs) to significantly shorten their investment durations.

Short-Term Traders Exit—Is Support on the Horizon for ADA?

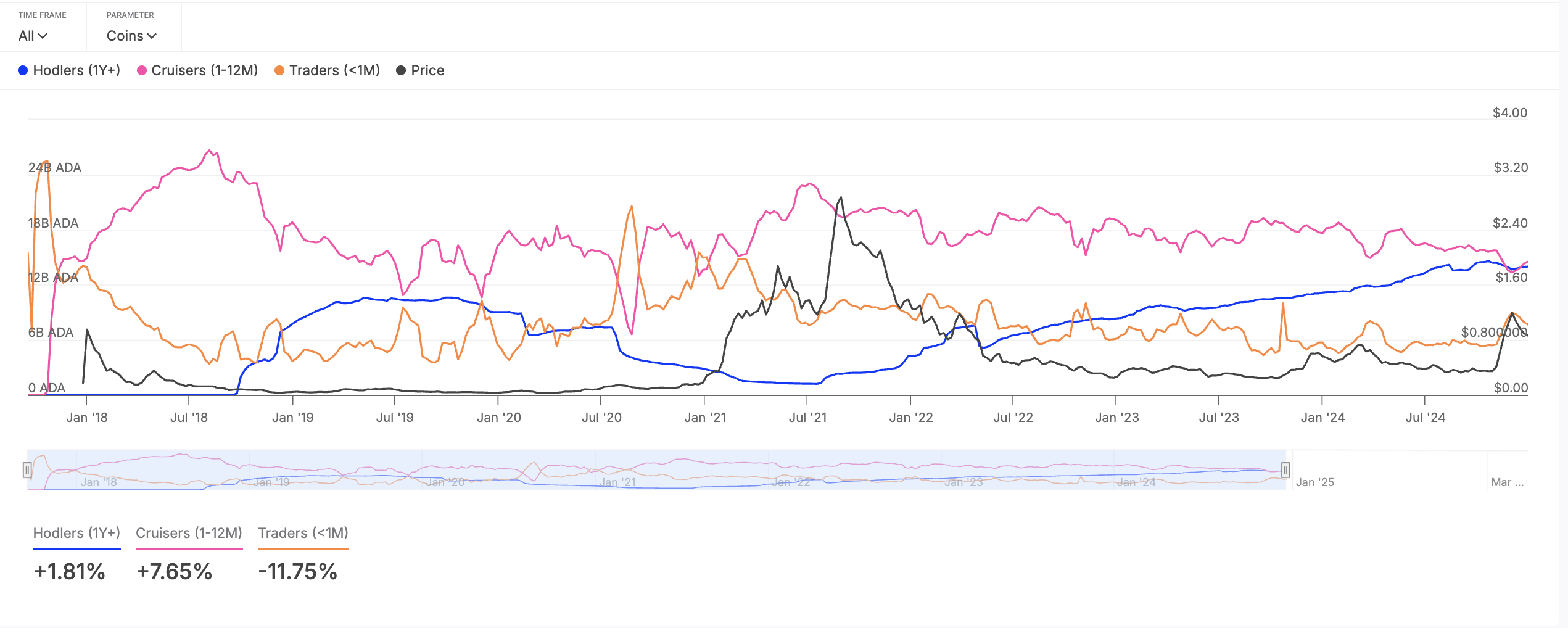

Short-term holders, referring to those who typically retain assets for less than a month, have notably decreased their ADA holding durations as prevailing bearish sentiment grips the cryptocurrency market.

Insights from IntoTheBlock reveal that these investors have curtailed their holding times by 12% over the last month, contributing to the ongoing price drop of ADA.

This decrease in STH activity signals waning confidence in ADA's potential for a swift recovery. If the selling trend persists, ADA may struggle to establish a robust support level unless long-term investors or institutional buyers step in to absorb the sell-offs.

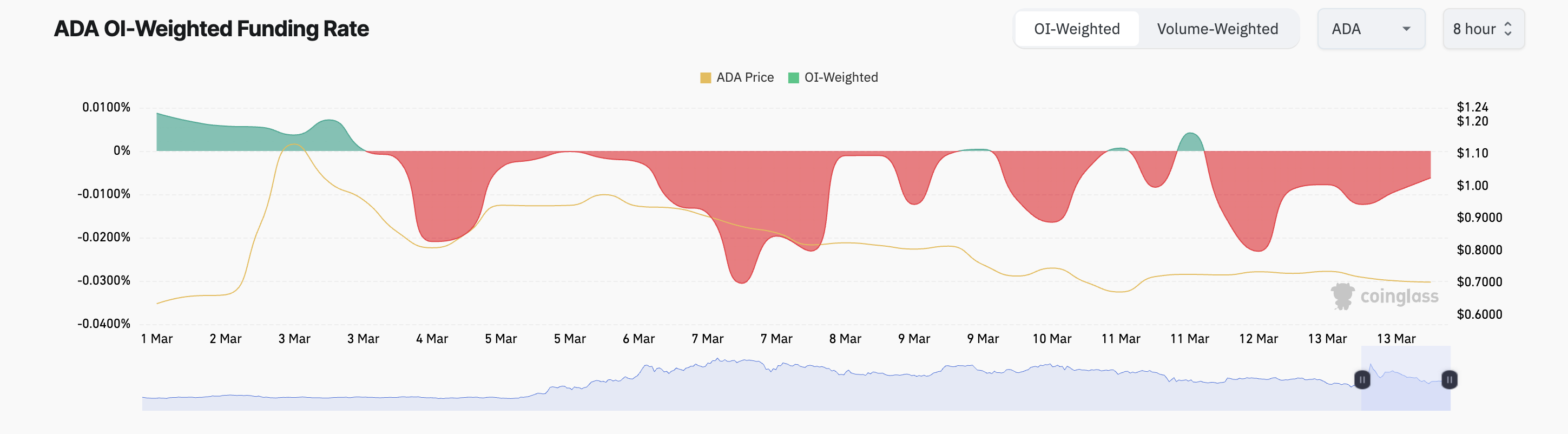

Moreover, ADA's funding rate across derivative markets has been consistently negative, which reinforces the prevailing bearish sentiment. As per Coinglass data, the current funding rate stands at -0.006%.

The funding rate represents a periodic fee exchanged between long and short traders in perpetual futures contracts, intended to keep contract prices in line with the spot market. A negative funding rate indicates that short traders are compensating longs, suggesting that bearish sentiments dominate and that more investors are betting on price declines.

Growing Selling Pressure on ADA

ADA’s recent price fluctuations have pushed it below the 20-day exponential moving average (EMA) on the daily chart. This crucial indicator reflects an asset's average price over the last 20 trading days, placing more emphasis on recent price movements.

When ADA’s price falls beneath this critical moving average, it signals a decrease in market momentum and hints at a potential short-term downtrend. Traders often perceive this as a bearish signal that may lead to increased selling pressure and further price declines.

If this trend continues, ADA could potentially drop to around $0.60.

Conversely, a bullish momentum could result in a breakout above the resistance level of $0.72, potentially pushing the price toward $0.82.