Bitcoin Eyes $91K Breakout: Are Holders Ready for a Shift?

Bitcoin Eyes $91K Breakout: Are Holders Ready for a Shift?

Bitcoin is gearing up for a potential breakout that might elevate its price past the $91,000 mark. Currently, the premier cryptocurrency is trading within a symmetrical triangle pattern, indicating a prospective bullish movement.

However, this forthcoming rally encounters obstacles as short-term holders (STHs) revise their positions and long-term holders (LTHs) exert selling pressure.

Short-Term Holders Show Signs of Change

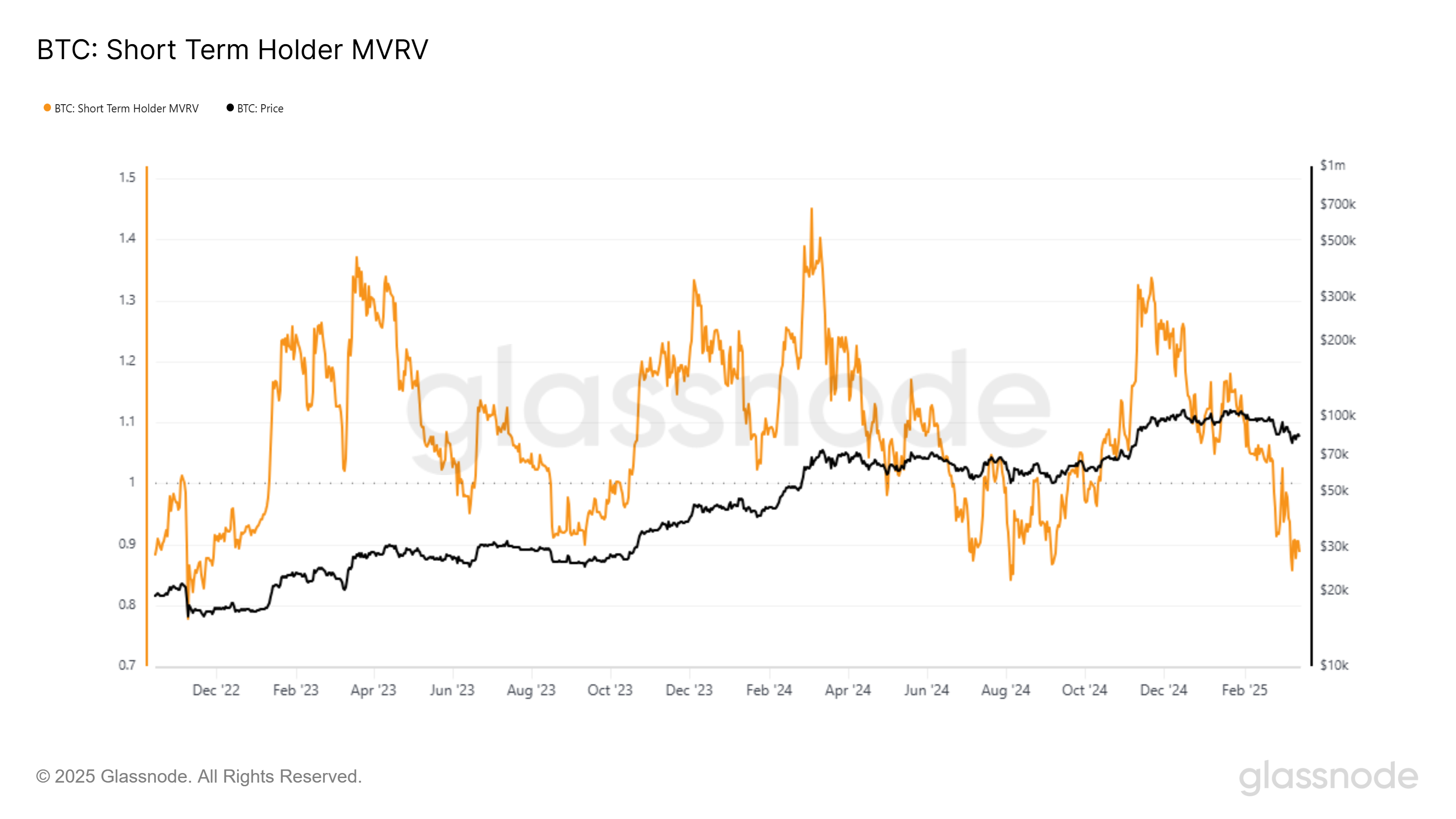

The Short-Term Market Value to Realized Value (MVRV) has dipped below the significant 0.9 threshold, a level historically associated with saturation points for STH selling. This decline often heralds the conclusion of a selling phase, foreshadowing a potential price reversal. If history provides any guidance, Bitcoin might soon experience renewed buying interest, paving the way for recovery.

Bitcoin has demonstrated a tendency to rebound in price when the Short-Term MVRV reaches these low levels. If this trend persists, we may witness a surge in BTC’s price in the short term.

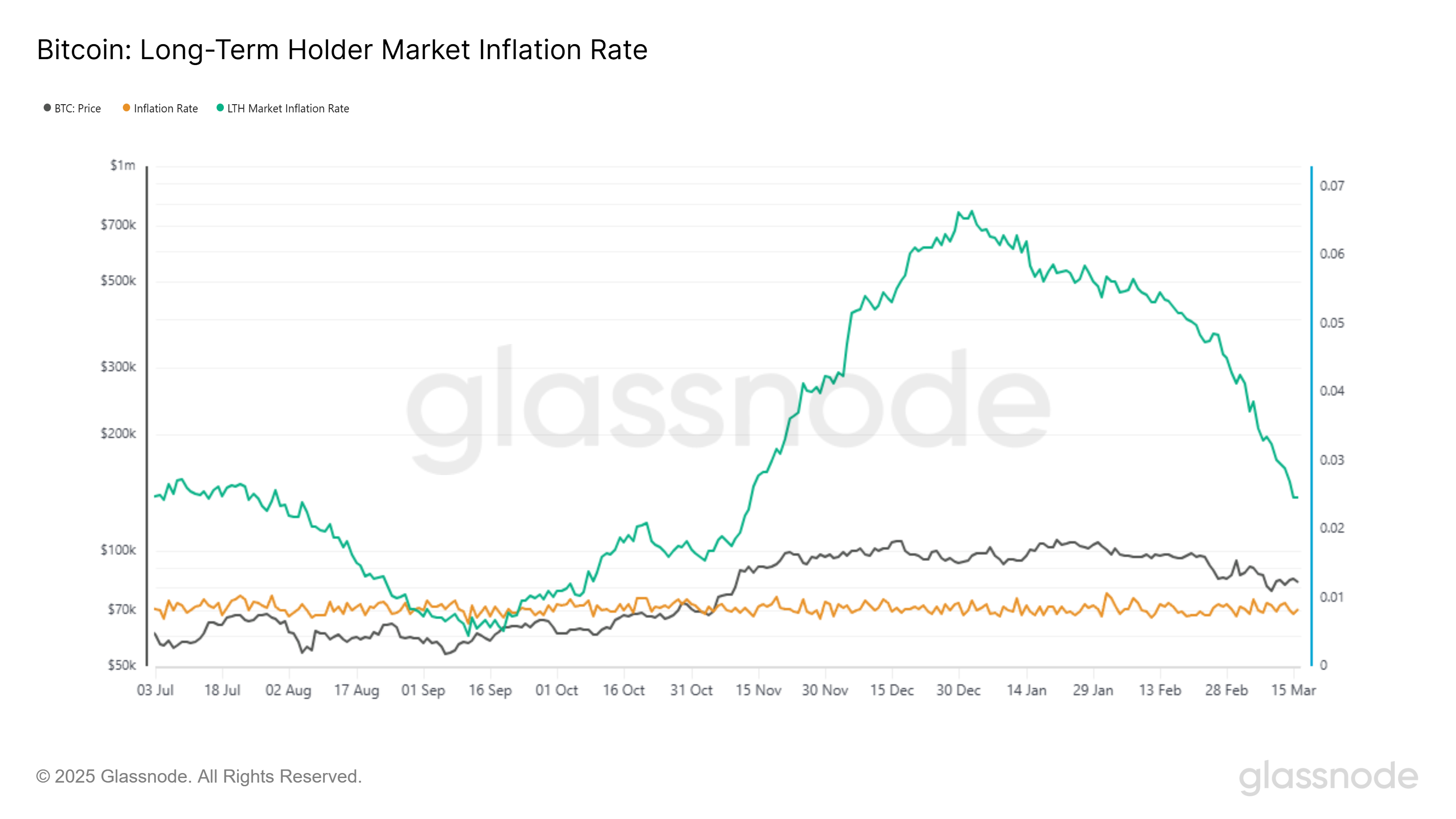

On the other hand, the Long-Term Holder Market Inflation Rate, which measures the net change in accumulation or distribution by LTHs against miner issuance, currently sits at 0.025. This suggests that LTHs are still exerting sell-side pressure. While this metric shows a downward trend, it continues to influence Bitcoin’s price movements.

Once the LTH Market Inflation Rate falls below the miner issuance levels (0.008 inflation rate), it’s anticipated that the pressure on Bitcoin’s price could diminish. This alteration would enable BTC to gain momentum, enhancing its chances of breaking through current resistance levels. Until that shift occurs, the market may remain susceptible to fluctuations attributed to LTH selling activities.

Bitcoin Price Movement: A Look Ahead

As of now, Bitcoin is trading at approximately $83,336, maintaining its position above the critical support level of $82,761. The symmetrical triangle pattern indicates a potential breakout of approximately 8.8%, a movement that could elevate BTC in the coming days.

For a breakout target of $91,521 to materialize, Bitcoin first needs to overcome the $85,000 mark and establish $87,041 as a solid support level. Reaching these milestones could bring Bitcoin closer to reclaiming its recent losses, bolstering a bullish perspective for the cryptocurrency.

Conversely, should Bitcoin fail to breach the $85,000 resistance, it might revert back to the $82,761 support level or even decline further to around $80,000. Such a scenario would negate the bullish pattern, leading to increased downside risks and postponing any prospects for recovery in the short term.