AAVE Surges 20% Following Innovative Tokenomics Proposal

AAVE Surges 20% Following Innovative Tokenomics Proposal

The decentralized finance (DeFi) token AAVE has distinguished itself as the leading market performer over the last 24 hours, experiencing a remarkable 20% increase. This surge can be attributed to the announcement of a new governance proposal aimed at overhauling the protocol's tokenomics.

The community's positive reaction to this proposal has driven heightened demand for AAVE in the past day. If this momentum persists, it is possible that the altcoin will continue to record gains in the near future.

Aave’s Aavenomics Proposal Initiates Price Surge—Is It Sustainable?

On March 4, Marc Zeller, founder of the Aave Chan Initiative (ACI), introduced a comprehensive proposal detailing the initial phase of the Aavenomics update.

This proposal comes on the heels of a TEMP CHECK approved in August 2024 and aims to revise AAVE's tokenomics, redistribute excess revenue generated by the protocol, phase out the LEND token, and introduce Anti-GHO to enhance incentives for GHO stablecoin holders.

The positive feedback from Aave DAO members has attracted significant market attention to the AAVE token, leading to its impressive 20% price jump in the past 24 hours, making it the top performer in the market.

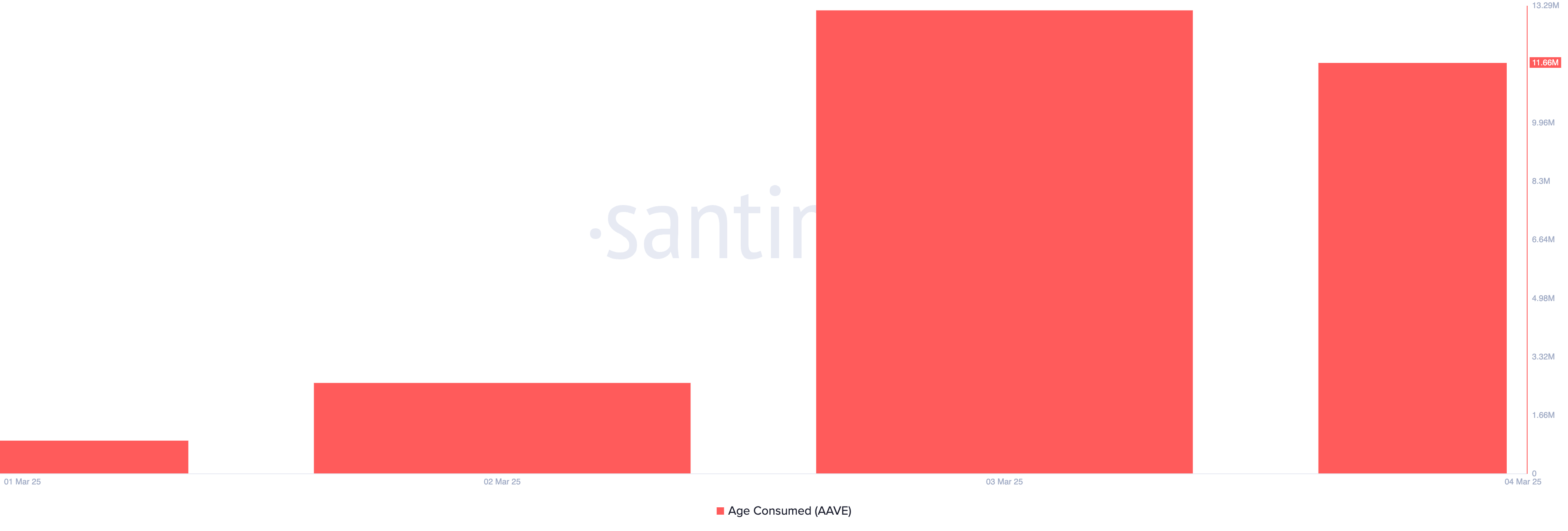

Interestingly, this sharp increase has prompted long-term AAVE holders to begin trading their tokens, as evidenced by a spike in the age-consumed metric, which tracks the movement of coins held for extended periods. According to Santiment data, this metric reached 11.66 million on Tuesday.

This increase is notable since long-term holders typically do not frequently move their tokens. Therefore, such activity during a price uptick suggests potential shifts in market dynamics. Significant spikes in the age-consumed metric during a rally might indicate that long-term holders are cashing out, which could elevate selling pressure on the asset.

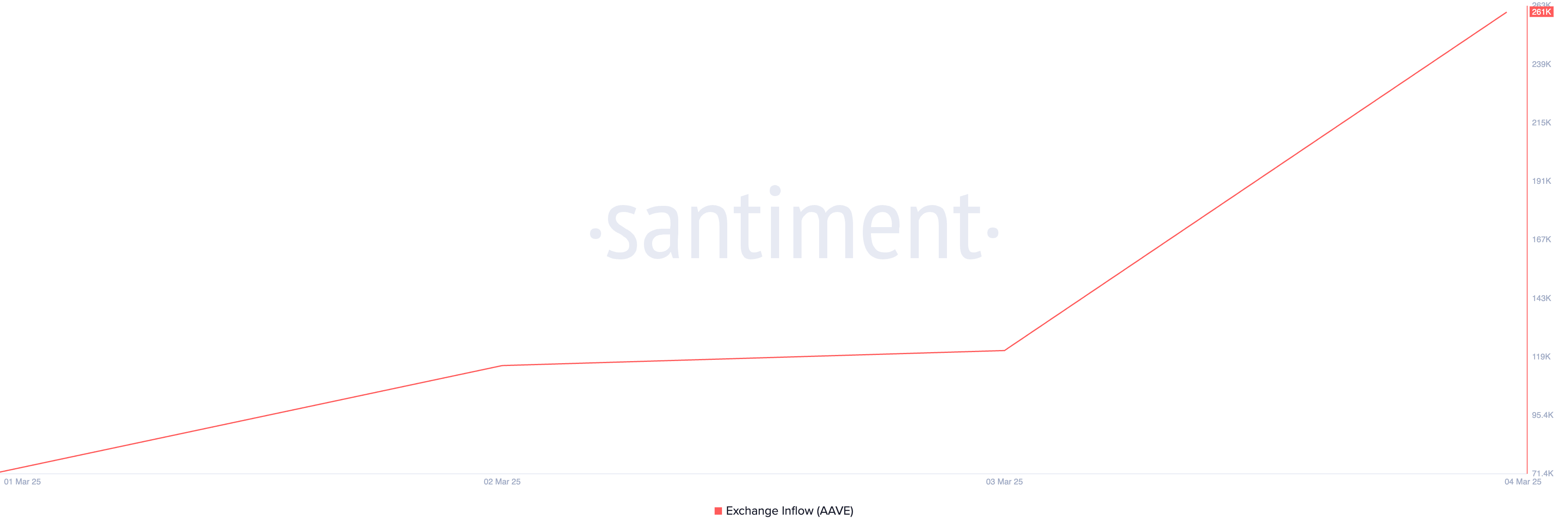

Additionally, the noticeable rise in AAVE's exchange inflow on Tuesday further corroborates this selling activity. Santiment reports that this metric, which tracks the volume of an asset sent to exchanges, surged by 114% during the reviewed period.

A significant increase in an asset's exchange inflow typically indicates a higher selling volume, which could place downward pressure on AAVE's price, risking a decline from its recent gains.

AAVE Sustains Above Key Support at $199.80 – Will the Bullish Trend Continue?

AAVE is currently trading at $211.45, hovering just above the support threshold set at $199.80. Should selling pressures persist, the bulls may find it challenging to uphold this support level.

Should this level be breached, a decline towards $145.42 could occur, marking a low not seen since November 2024.

Conversely, if the bullish trend continues and new demand for AAVE increases, the price may rise towards $238.